Forecasting Bitcoin: What Comes After the Halving?

Facing the Bitcoin Halving in about 2 Days, let's dive into what the effects on the price could be once we break out of the consolidation.

Since the halving has not happened yet and the supply still increases by 6.25 Bitcoin per new created block which equals about a 1.7% inflation, we still have not had the event that is supposed to explain this crazy run over the last couple of months. If we were talking about anything besides Bitcoin, everybody would be telling you that this would be a "Buy the rumor, sell the news" event.

Also, the fact that Bitcoin is still an inflationary asset is something many Bitcoin fanboys do not want to accept, as there is a final amount of Bitcoin (21 Mio.) that can ever be created. And with all the lost Bitcoin in wallets from 10 years ago, forgotten seed phrases, and other reasons, there's even less Bitcoin than the 21 Million.

If we put aside those rare instances, it's still the fact that even after the halving there will be an 0.85 % inflation of Bitcoin, which is still a lot better than pretty much every other currency out there atm, that's for sure.

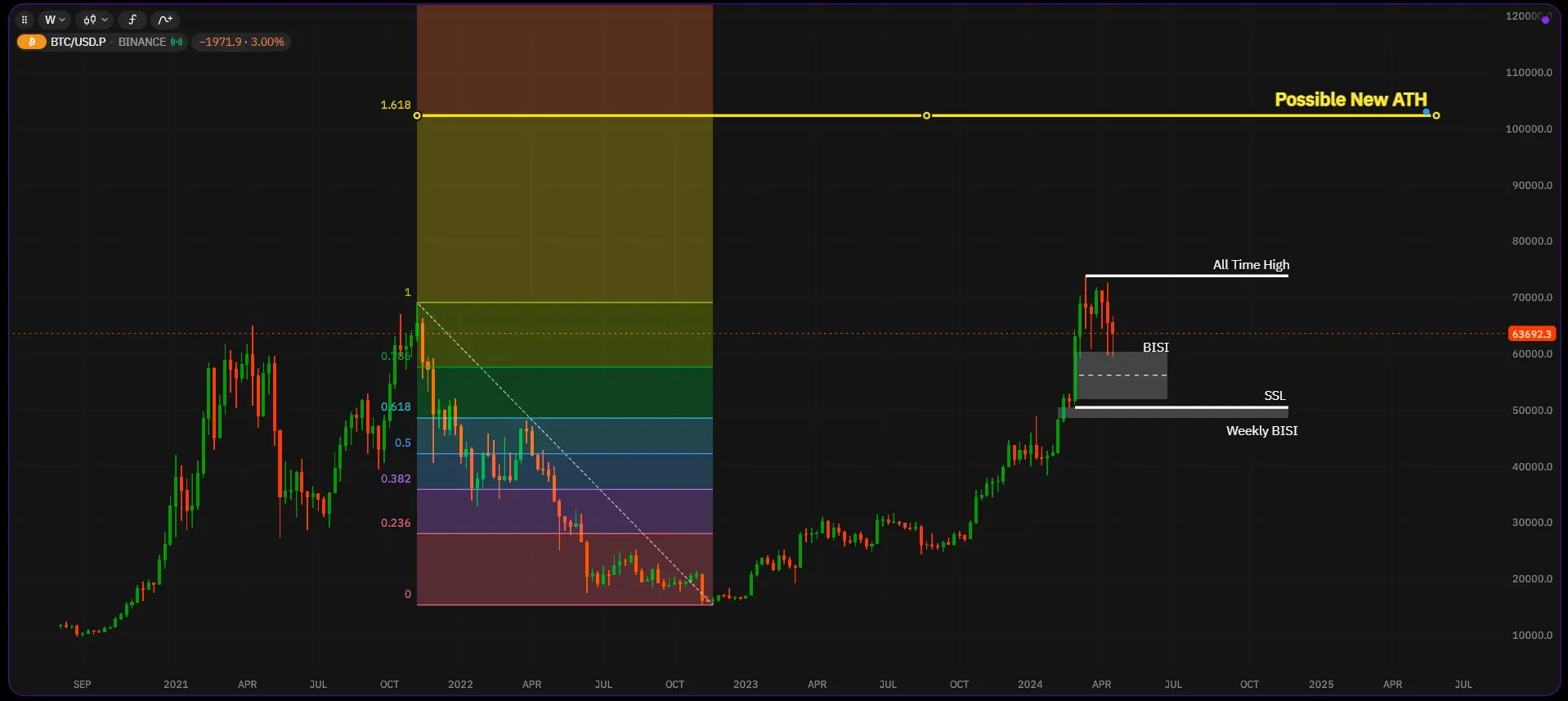

So, having talked a bit about the background and recent news, let's dive into the charts!

Let's look at the Daily chart first

The newly created high created about a month ago at $73915.30 is the next target for buy stops/Buy Side Liquidity (BSL) which are buy stops placed above 2 highs that are deemed a resistance level by traders and algorithms. The fact that the others highs around that level are lower to the right makes it "low resistance" and thus a high probability to be run to in the future.

If we now assume that we'll continue to drop in price, it would make a great short entry as we would expect a low resistance liquidity run. But since, with all the news for example the first approved Bitcoin Spot ETFs (we can assume that the accessibility of Bitcoin for the public will continue to improve) we're expecting the price to surge. So for Short Term Trades, a run to the old ATH would be great for a first TP (Take Profit) and to move the Stop to BE (Break Even).

Please note that I said that a bigger wick is possible not, that there's gonna be one, just that there is apossibility for one.

Let's look at the Sellside real quick:

We dipped into a FVG (Fair Value Gap) in the form of a BISI (Buyside Imbalance Sellside Inefficiency) 3 times, but always closed outside the Gap. Looking for price to expand, we don't want it to close below the 50% mark of the FVG as it would make it more likely to expand to the downside (at least for the short term).

In this case, keep the relatively equal lows marked on the chart in mind. Below is another target for a short scenario in the form of another BISI in the Daily which could be reclaimed and a superordinate big one in the weekly chart.

Long Term Target

Using a Fibonacci Extension from the high of the last bull market to the low of the bear market we get a price target of ~ $102400 at the 1.618 Extension as thus Bitcoin would break the $100k mark.

However, from personal experience in the crypto space, having traded a bunch of altcoins before I can say that often, when a price target is hoped for by the entire community it often falls short of it just a tiny bit which makes sense considering that there might be big money driving price who don't want retailers getting their orders filled and prefer falling short of a big milestone of a "simple ticker" when it means getting out of their position before everybody else does.

Conclusion

My short-term targets are, as I said, the new ATH & some "non-ICT-targets" being $75225 & $79475. My more or less long-term HODL bag will be getting smaller partially along the way until it can be reallocated at a higher probability trading setup.

Thanks for reading! Feel free to drop your comments below and let's enjoy the ride together!🔥🚀

to activate earnings with sharing